A new survey by Bain & Company shows that energy and natural resources executives continue to invest in low-carbon businesses, despite expecting a short-term slowdown in decarbonization due to recent turmoil in energy markets.

The survey involved over 600 global executives and found that while executives remain committed to their long-term net zero goals, they anticipate challenges shortly. The reliance on coal is expected to increase due to shortfalls in Russian-supplied natural gas. Consequently, many executives anticipate a shift in focus toward addressing scarcity and affordability in the coming years.

Despite the expected challenges, executives are relatively confident in their abilities to meet net zero goals and believe their companies outperform the rest of the world in reducing emissions. The survey also revealed that executives, on average, expect the world to achieve net-zero carbon emissions by 2057. They anticipate emissions reductions to align with current pledges until 2030 and accelerate after that. The International Energy Agency estimates that achieving this goal would require clean energy investments to increase from $1 trillion today to $4 trillion by 2030.

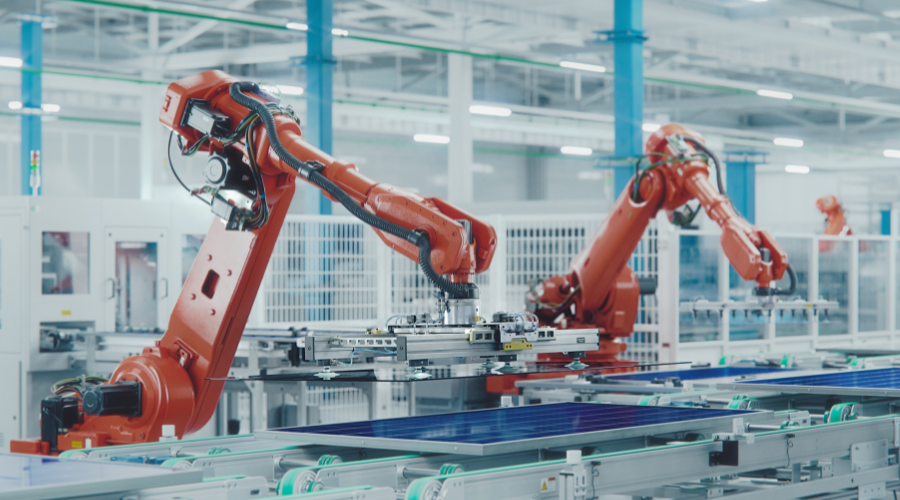

Companies plan to allocate approximately a quarter of their capital to new growth businesses in 2023, focusing significantly on low-carbon technologies. While accessing capital for these initiatives is not a major concern for most executives, ensuring acceptable returns on these investments remains a key barrier to decarbonization. Four out of five executives view generating satisfactory returns as a significant challenge, primarily due to concerns about customers’ willingness to pay for low-carbon products. To bridge this gap, executives look to government policies and regulatory support.

Regional variations in perspectives were observed, with European oil and gas executives expressing increased concern about policy uncertainty compared to the previous year. In contrast, fewer executives in North America attributed delayed investment decisions to policy uncertainty, potentially reflecting the effects of recent government policy changes in the region. Government policy and permitting were identified as major roadblocks to the growth of new low-carbon businesses in the sector. Asian executives, in particular, identified technology as a top barrier.

Renewables, artificial intelligence (AI), and energy storage will emerge as the most critical technologies for the energy and natural resources sector through 2030. Executives in the Middle East displayed optimism about hydrogen and carbon capture, while executives in other regions expect these technologies to become more important after 2030.

Building organizational capabilities and finding talent were major challenges in scaling low-carbon businesses. Digital and information technology talent scarcity was highlighted across all sectors and regions. While 60% of executives anticipate significant changes to their businesses by 2030 due to digital and AI technologies, they face difficulties finding suitable talent to manage this transformation. Additionally, one in three companies reported challenges in finding engineers, and one in four experienced difficulties hiring frontline workers, especially in North America.

In the Middle East, talent was identified as the top roadblock to scaling growth businesses, with 42% of companies facing challenges in finding frontline workers and 33% struggling to recruit sales and marketing talent. Conversely, the market for frontline workers appeared more favorable in Latin America and Asia.

The survey findings highlight the challenges and opportunities facing the energy and natural resources sector as it transitions to a low-carbon future. While executives are committed to decarbonization, they face several hurdles, including access to capital, consumer willingness to pay, and the availability of talent. To overcome these challenges, executives must work closely with governments and other stakeholders to develop policies and programs that support the transition to a clean energy future.